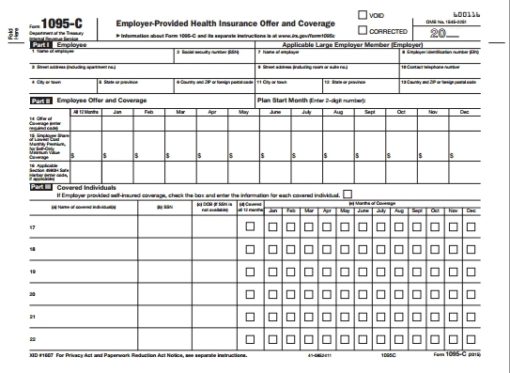

· Information included in the Form 1095C (including an explanation of Part III for selfinsured plans) Descriptions of why an employee may receive multiple Forms 1095C As a special bonus, we have also included a sample employee letter for use by small selfinsuring employers —generally those with fewer than 50 fulltime employees (including fulltime equivalent employees)—regarding Form · The 1095 forms are filed by the marketplace (1095A), other insurers (1095B), or by your employer (1095C) We have simple instructions for the 1095 forms Keep in mind the 1095 forms are filed by whomever provided you coverage, so individuals won't have to2910 · The new 1095C codes have not been applicable to any tax years outside of Employers, read on to learn what they mean and how to use them accurately2 minute read We recently covered the ins and outs of the ACA's Form 1095C Now, we will be covering the new codes that are anticipated for the tax

Form 1095 C The Aca Times

How to get the 1095 c form

How to get the 1095 c form-0416 · You'll send 1094C and 1095C to the IRS, and you'll also give a personalized copy of the 1095C to every single person on your team 3 Which brings us to the next point — there's a good reason for you to fill them out The entire reason these forms exist is to show the IRS that you're providing your team with meaningful health careRelease Memo PDF Updated () Schemas 1094B, 1095B, 1094C and 1095C ZIP () Version 10 Note Includes a DIFF file from the previous version Business Rules Versions PDF and CSV Formats ZIP Posted (Version 10) Back to AIR TY Main Page Page Last Reviewed or Updated 22Oct

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

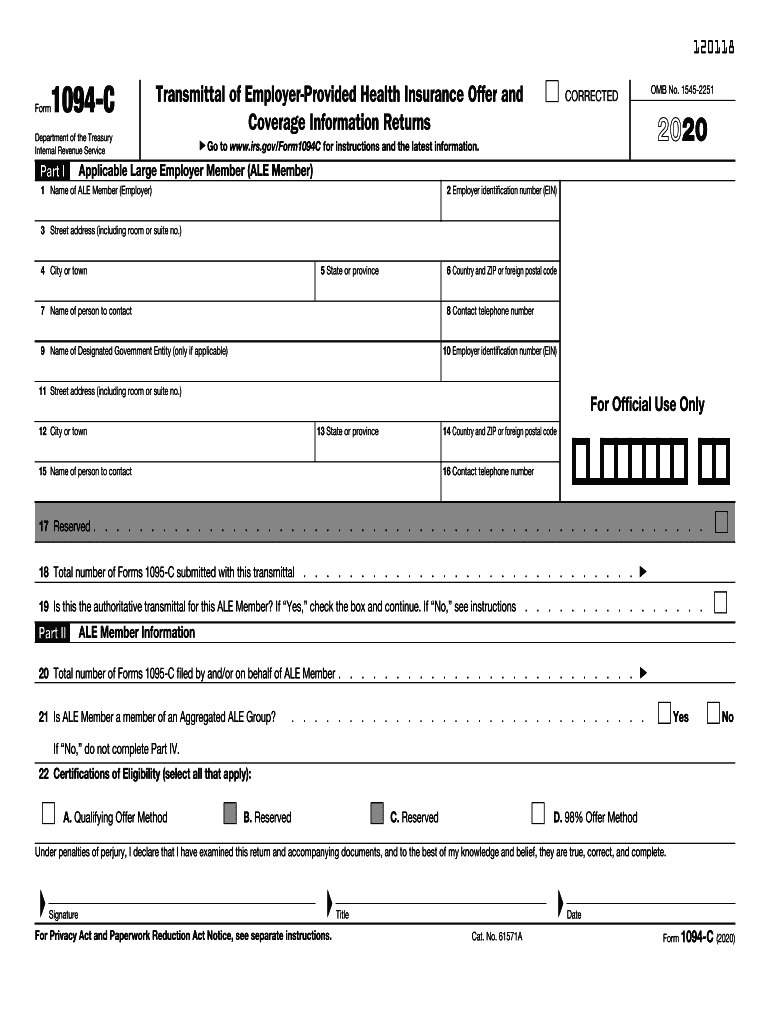

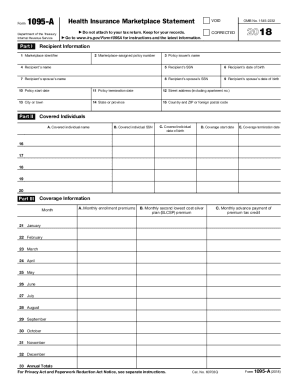

· For a full list of the codes that could be entered on Line 16 of Form 1095C, head to our post The Codes on Form 1095C Explained If your organization is unsure of how to properly prepare your 1094C and 1095C forms for the tax year, contact us to see how we can help you meet your ACA Employer Mandate responsibilities with ACA CompleteForm 1094C Department of the Treasury Internal Revenue Service Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Go to wwwirsgov/Form1094C for instructions and the latest information OMB No Part I Applicable Large Employer Member (ALE Member) 1 Name of ALE Member (Employer) 2Form 1095A is provided here for informational purposes only Health Insurance Marketplaces use Form 1095A to report information on enrollments in a qualified health plan in the individual market through the Marketplace As the form is to be completed by the Marketplaces, individuals cannot complete and use Form 1095A available on IRSgov

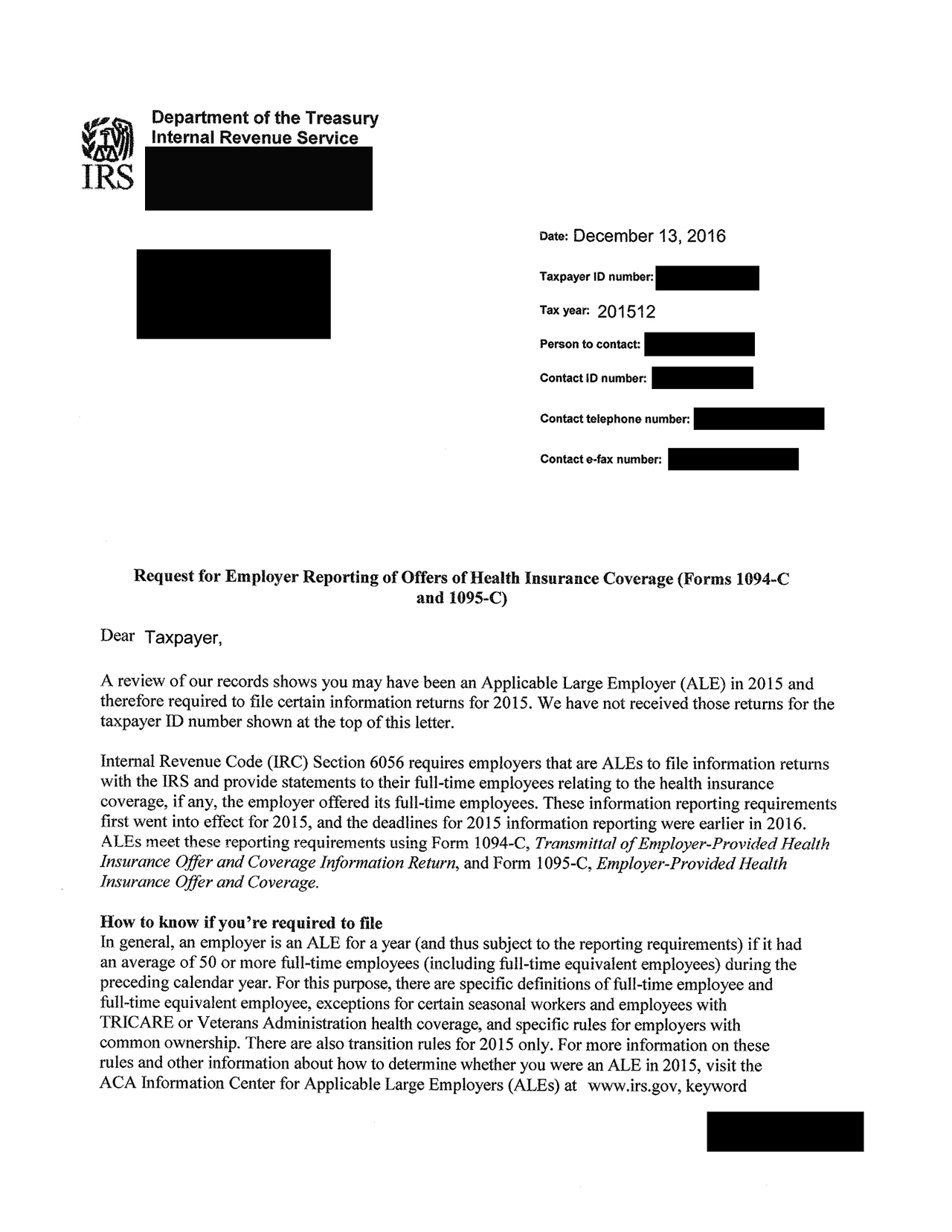

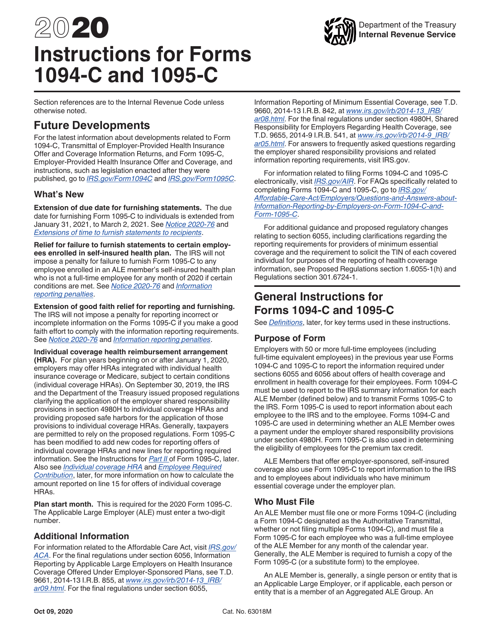

For calendar year , Forms 1094C and 1095C are required to be filed by March 1, 21, or March 31, 21, if filing electronically See Furnishing Forms 1095C to Employees for information on when Form 1095C must be furnished14" 1095C Pressure Seal Z FoldContent updated on February 11, To manage the risk of Affordable Care Act penalties, employers can use one of three affordability safe harbors for reporting on Line 16 of IRS Form 1095C

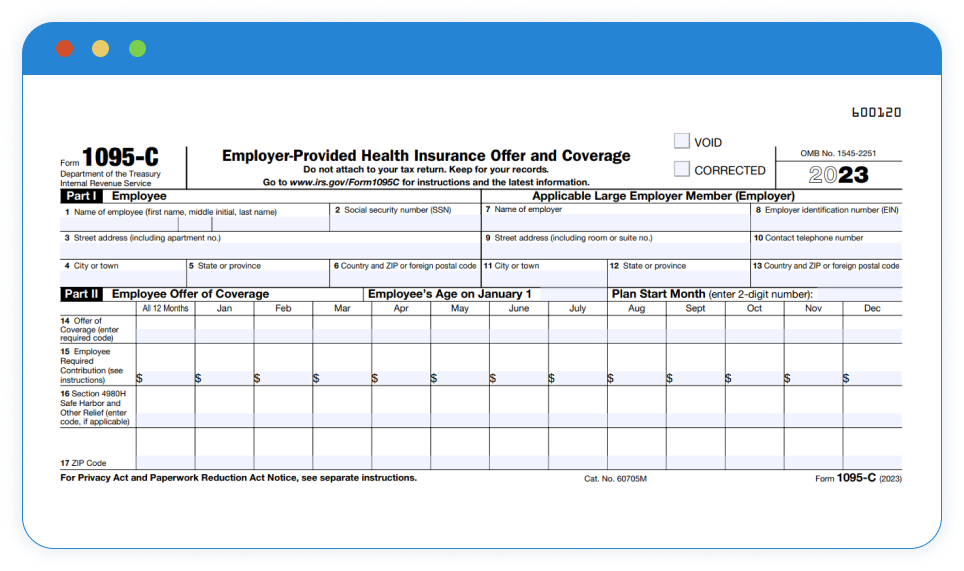

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy & Safety How works Test new features Press Copyright Contact us Creators1111 · The new form covers HRA plan years starting Jan 1, New codes for the 1095C For tax year , Form 1095C gets updated with brandnew offer codes employers can enter in line 14 You'll use it to indicate the type of HRA coverage offered to employeesForm 1095C is used by applicable large employers (as defined in section 4980H(c)(2)) to verify employersponsored health coverage and to Form1095C Colorado State University Colorado State University provides employees with the 1095C tax form

1095 C Form Printable Fill Online Printable Fillable Blank Pdffiller

Common 1095 C Coverage Scenarios With Examples Boomtax

Form 1095C's for the University of Pittsburgh employees for the tax year are to be mailed in January 21 If you believe you should have received a Form 1095C but did not, please contact the University of Pittsburgh's Benefits DepartmentOn July 13, , the IRS released the final instructions of the Form 1095C to be used for reporting in the tax year The revised Form 1095C has a new line (Line 17, Zip Code) related to ICHRA information There is also a new series of ACA codes from 1L to 1S to be entered on Line 14, Offer of Coverage, that refer specifically to the ICHRA1407 · On July 13, , the IRS published the draft Form 1094C and draft Form 1095C for the tax year While the forms are not the final version, currently the Form 1094C remains unchanged However, there are some significant updates to the 1095C draft form

1094 C 1095 C Software 599 1095 C Software

.png)

What Payroll Information Prints On Form 1095 C To Employees

Creating the 1095C spreadsheet to be imported Although you can create your own spreadsheet to import 1095C information for your clients' employees, we recommend that you use the 1095C template spreadsheet that we have made available for exportThe 1095C template spreadsheet exports from Accounting CS populated with basic employee information that is formatted to match the Sample 1095CIRS Form 1095C Filing Instructionsfor 21 Updated November 05, 800 AM by Admin, ACAwise Every year, ALEs (Employers with 50 employees) must report to the IRS about their offered health coverage information to the employees The information is to be reported through Form 1095C under section 60560602 · ALEs filing electronically must file the Form 1094C transmittal (and copies of related Forms 1095C) with the IRS by March 31, Electronic filing is mandatory for ALEs filing 250 or more Forms 1095C for the 19 calendar year;

What Payroll Information Prints On Form 1095 C To Employees

What Is The Irs 1095 C Form Miami University

1095c Departmant of Træsl_ry Internal RevenlÆ Service Part I Employee 1 Name of employ— Employee Smith 3 Stræt address apartment ro) 123 Maple Drive Unit 2 EmployerProvided Health Insurance Offer and Coverage Do not attach to your tax retum Keep for your records Information about Form 1095C and its separate instructions is at CORRECTEDInst 1094C and 1095C Instructions for Forms 1094C and 1095C Form 1095A Health Insurance Marketplace Statement Inst 1095A Instructions for Form 1095A, Health Insurance Marketplace Statement Form 1095B Health Coverage Form 1095C0321 · The IRS extended the deadline to provide employees with copies of their 1095C or 1095B health coverage reporting forms from Jan 31 to March 2, 21, and again extended

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Common 1095 C Coverage Scenarios With Examples Boomtax

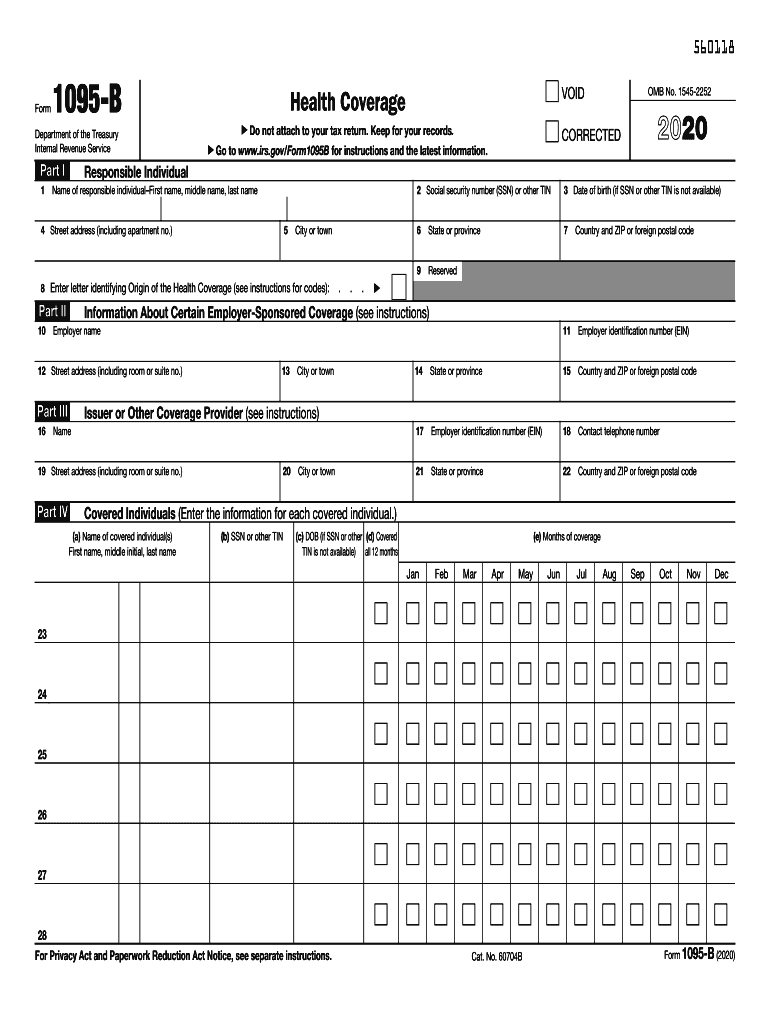

· 1095B – This form is used by insurance companies to report information about individuals who are covered by minimum essential coverage and are not liable for the individualshared responsibility payment ;1095C – This form is used by fullyinsured and selfinsured ALEs to1510 · Extended Deadline to Furnish Forms 1095C to Employees IRS Notice 76 announced an extension of the deadline to furnish Forms 1095C to employees until March 2, 21, but employers are encouraged to furnish such statements as soon as possible The extension is automatic and does not need to be requested

Guide To Correcting Aca Reporting Mistakes Onedigital

1095 C Reporting How To Use Affordability Safe Harbors For Integrity Data

The 1094C and 1095C filings used by Applicable Large Employers along with employee tax returns will be used by the IRS to determine if the employer owes a shared responsibility payment and whether employees are/were eligible for a premium subsidy Any penalties will be calculated and communicated by the IRS in Letter 226J Employers owe the IRS aACA Form 1095 C CodeSheet for Line 14 and Line 16 Updated on January , 21 1030am by, TaxBandits Choosing codes to report on lines 14, 15, and 16 of 1095 C might be a tedious process for anyone But, when you look closely, it is pretty much simple0121 · IRS Form 1095C is used by Applicable Large Employers (ALEs) to report the health insurance coverage information provided to their fulltime employees and employee's dependents For the tax year , form 1095C has been updated And, employers should use the updated 1095C form to file with the IRS this year

Sample 1095 C Forms Aca Track Support

Irs Form 1095 C Download Fillable Pdf Or Fill Online Employer Provided Health Insurance Offer And Coverage Templateroller

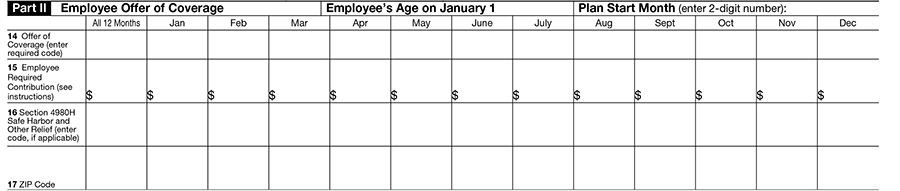

· If you are an annuitant who was employed for a portion of , you will also receive an IRS Form 1095C Otherwise, annuitants will not receive this form If you worked for more than one agency or changed pay status (such as retiring or separating from the military) during the tax year, you may receive more than one IRS Form 1095B and/or 1095C for the same yearForm 1095C is intended to include all the necessary information to allow the recipient and/or the tax preparer to properly complete and file the recipient's tax return All applicable large group employers (ALE's) are required to prepare, distribute and file IRS Form 1095C This form includes information that will2121 · When populating Form 1095C, employers are communicating a lot of information through a series of codes It is incredibly important for an employer to have documentation supporting the codes they are using when populating the Forms Employers should remember that there are a number of new 1095C codes specific to the

Irs Form 1095 A Download Printable Pdf Or Fill Online Health Insurance Marketplace Statement Templateroller

Ez1095 Software How To Print Form 1095 C And 1094 C

2707 · On July 13, the IRS released for comments a draft of Form 1095C EmployerProvided Health Insurance Offer and CoverageSeries 1 and Code Series 2 in lines 14 and 16 of Form 1095C The IRS will then review the codes used and determine whether you are compliant with your employer mandate ACA requirements ACA FORM 1095C CODE SERIES The IRS has designed two sets of ACA codes to provide employers with a way to describe health coverage offers on Form 1095C · Self‐insured employers must report offers of COBRA coverage Employers complete Form 1095‐C providing COBRA coverage information (enrollment in COBRA coverage) How the Form 1095‐C is completed will depend, in part, on whether the employee was covered as an active employee during 18

Form 1095 C Forms Human Resources Vanderbilt University

Employers Are You Unsure Of The Coding On Forms 1094 C And 1095 C The Aca Times

· This change would allow the Federal Form 1095C be used to satisfy the new State reporting requirements that go into effect in For example, the State of New Jersey enacted its own individual mandate in 19 in response to the Federal individual mandate being repealedDeadlines The IRS has extended the deadline to furnish the ACA Forms 1095B / 1095C recipient copies from January 31 st, 21 to March 02 nd, 21 Penalties As for Form 1095C, the IRS will not impose a penalty for failure to furnish it in regards to any employee that is enrolled in an ALE member's selfinsured health plan who is not a fulltime employee for any month of0211 · The forms largely mirror the 19 versions, but they include a few substantive changes Employers must now complete the previously optional "Plan Start Month" box on Form 1095C The Instructions and forms include substantial updates affecting employers that offer Individual Coverage Health Reimbursement Arrangements (ICHRA)

Aca 1095 C Basic Concepts

Instructions For Forms 1095 C Taxbandits Youtube

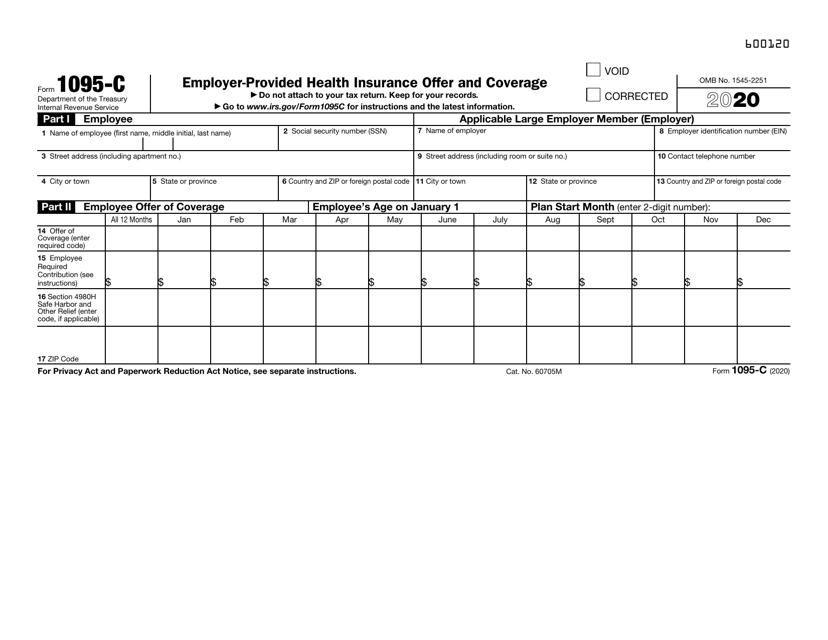

1910 · IRS Releases Instructions for Forms 1094C and 1095C with Most Substantial Changes in Years On October 14, the IRS finally released its draft instructions for the Forms 1094C and 1095C Confusingly, the IRS appears to have released the final instructions the next day This is disappointing as commenters will not get to be heard before2909 · Part II of the Form 1095C now requires an employer to enter the employee's age as of the beginning of the calendar year ZIP Code The embedded Instructions for Recipient section in Form 1095C indicates that employers that offer ICHRAs to employees must disclose the employees' ZIP Codes if the employer uses the employee's location to determine affordability as0505 · Employee was Enrolled in a UnionSponsored Plan All Year 1 FullTime Employee Enrolled All 12 Months, qualifying offer In this example, the employee (EE) was enrolled in a plan that provided Minimum Essential Coverage (MEC) at Minimum Value (MV) This plan was offered to the EE, the spouse and dependents

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

Aca Forms 1094 C And 1095 C And Reporting Instructions For Irs Issues Final Aca Forms 1094 C 1095 C And Reporting Instructions

Reference Guide for Part II of Form 1095C Lines 14, 15, and 16 (revised for the final 17 forms) November 17 • Lockton Companies L O CKT O N CO M P ANIES GLOSSARY Children means an employee's biological and adopted children (including children placed with the employee for adoption), from birth, adoption, or placement through the end of the month in which the childStep 5 Print Tax Form 1094C Click the top menu "Current Company" then the sub menu "Form 1094C" to view 1094C screen Note ez1095 software can print both 1095C and 1094 C forms for IRS and recipients on white paper No preprinted form is needed IRS changed form format in Year The Form has 2 pages Year 1519 form has only · Sample Excel Import File 1095C xlsx What's New for In Part 2, added field "Employee's Age on January 1" before the Plan Start Month field New codes for line 14

Spreadsheet Import Form 1095 C

Irs Updates To New Form 1094 C And 1095 C Drafts Bernieportal

Let's Look At The Most Common 1095C Coverage ScenariosForm 1095C Department of the Treasury Internal Revenue Service EmployerProvided Health Insurance Offer and Coverage Do not attach to your tax return Keep for your records Go to wwwirsgov/Form1095C for instructions and the latest information VOID CORRECTED OMB No Part I Employee 1 Name of employee (f2910 · ACA Form 1095C Filing Instructions An Overview Updated October 29, 800 AM by Admin, ACAwise When the Affordable Care Act was passed, the IRS designed Section 6056 of the Internal Revenue Code as a way to gather information on the health insurance coverage that ALEs offered to their employees

Aca 1095 C Basic Concepts

Ez1095 Software How To Print Form 1095 C And 1094 C

1300 · Form 1095C is now two pages instead of one An employee's age as of Jan 1, , and their ZIP Code must be included on the form Three new state filings will be introduced for Rhode Island, Vermont, and California

Aca Reporting Tip 19 Self Funded Plans Usi Insurance Services

Need A Duplicate W 2 Or 1095 C Authorize Web Delivery Of Your Tax Forms Montgomery County Public Schools

Accurate 1095 C Forms Reporting A Primer Integrity Data

Questions Employees Might Ask About 1095 C Forms Bernieportal

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

Form 1095 C The Aca Times

Aca Processing 1095 B 1095 C

1095 C Software 1095 C Software To Create Print And E File Irs Form 1095 C

The Irs Aca Audit Has Begun What To Do To Avoid Penalties The Aca Times

Form Irs 1094 C Fill Online Printable Fillable Blank Pdffiller

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

Form 1095 A 1095 B 1095 C And Instructions

Aca Reporting Tip 19 Self Funded Plans Usi Insurance Services

1095 C Form Official Irs Version Discount Tax Forms

Form 1095 C Adding Another Level Of Complexity To Employee Education And Communication The Staffing Stream

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

1095 Software Aca 1095 C Compliance Software 1095 Mate

Irs Form 1095 C Instructions For 21 Step By Step Filing Guide

1095 C Sample Hcm 401 K Human Resources

Annual Health Care Coverage Statements

1095 Tax Info Access Health Ct

Irs Form 1095 C Instructions For 21 Step By Step Filing Guide

Form 1095 C Guide For Employees Contact Us

Aca Reporting Penalties Abd Insurance Financial Services

Aca Reporting Tip 19 Self Funded Plans Usi Insurance Services

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Irs Health Coverage Reporting Form 1095 C Examples For Youtube

1095 A Form Fill Out And Sign Printable Pdf Template Signnow

Accurate 1095 C Forms Reporting A Primer Integrity Data

Yearli Form 1095 C

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

1095 A Tax Credits Subsidies For Form 62 Attaches To 1040 Covered Ca

F O R M 1 0 9 5 C E X A M P L E S Zonealarm Results

Irs 1094 C Form Pdffiller

Benefits 1095 C

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

Ez1095 Software How To Print Form 1095 C And 1094 C

Irs 1095 B 21 Fill Out Tax Template Online Us Legal Forms

1095 Tax Info Access Health Ct

Irs Form 1095 C Fauquier County Va

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

What S New For Tax Year Aca Reporting Air

F O R M 1 0 9 5 C E X A M P L E S Zonealarm Results

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

trix Irs Forms 1095 B

What Is The Difference Between A 1095 B And 1095 C Form

Checkmark 1095 Software For Aca Reporting Print E File Software

Sample 1095 C Forms Aca Track Support

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

Aca Code Cheatsheet

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

Form 1095 A 1095 B 1095 C And Instructions

Aca Reporting Tip 19 Self Funded Plans Usi Insurance Services

Control Files And Sample Forms

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Irs Issues Draft Form 1095 C For Aca Reporting In 21

Control Files And Sample Forms

Common 1095 C Coverage Scenarios With Examples Boomtax

F O R M 1 0 9 5 C E X A M P L E S Zonealarm Results

Form 1095 A 1095 B 1095 C And Instructions

1094 C 1095 C Software 599 1095 C Software

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

New 1095 C Codes Will Apply To The Tax Year Aca The New 1095 C Codes For Explained

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png)

About Form 1095 A Health Insurance Marketplace Statement Definition

10 Questions Employees Are Asking In 19 About Aca 1095s Word On Benefits

0 件のコメント:

コメントを投稿